This post contains affiliate links to things that I love!

When our boys were in elementary school, they started asking questions like “Can we have an allowance?” and “Why do we have to put our money into our savings account?” They were curious, and it was the perfect time for teaching our young children about money.

One powerful way to help children understand real-world money lessons is by setting up a custodial account in their name. Many parents choose UGMA accounts (Uniform Gifts to Minors Act accounts) because they allow you to save or invest on behalf of your child until they’re old enough to manage it themselves. If you’re new to the idea, this parent’s guide to UGMA custodial accounts explains exactly how they work and why they can be such a smart tool for families.

We have been teaching our kids about money for quite some time – talking about how and when we save and when we spend. We’ve always talked about donating money to those in need, supporting the church, and supporting our community. We talk about looking for great sales to save money, avoiding unnecessary purchases, and planning for our future.

These ideas will help you teach your children about these same things.

1- Give your child THREE jars.

Label one as SAVE. Label one as GIVE. Label one as SPEND.

I have heard some people say that they have their children put an equal amount into each jar (example: if they earn 75 cents, they would put 25 cents into each jar). This is a great way to get them started.

I have also heard that you could teach your kids to put 10% into giving, 40% into saving (long term), and 50% into spending. I personally like the idea of building up the savings by contributing the most to savings, but it is up to you and your child how you distribute the money.

Our 17 year old started saving for his first car when he was six years old. It was his choice… and when he turned 14, he bought it. He had not spent any of his birthday or holiday money for years while he was saving! He had his mind made up that he would have one by the time he was 16… and I could see that happening!

2- Have a Coin Toss in the Water game:

Set up the game–>> Fill a baby pool or a small storage tote with water and place a plastic bowl on top (the bowl will float on the water). Give each child $1.00 in change (I like to give them a variety of coins, to make adding it up a little more challenging). Have the kids toss the change into the bowl. When they are finished, they add up the amount of money in the bowl. If you are playing with friends, the person who got the most is the winner.

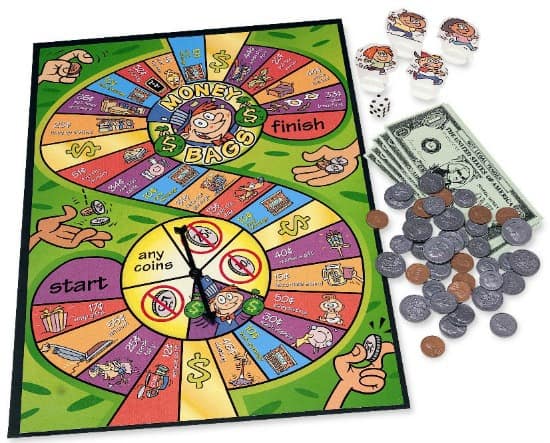

3- Play a money game.

When I taught second grade, I would set up learning centers in the room, and I always had this game as a center activity. It was my favorite game to teach kids about money, by far! We have it at our house, and our own kids have played it many times over the years. It teaches kids how to earn money (Example: “Clean the dishes- you have earned $1.75”) and how to spend it (Example: “Oh No! You broke your mom’s vase – pay $1.00”)

4- Read a book about money.

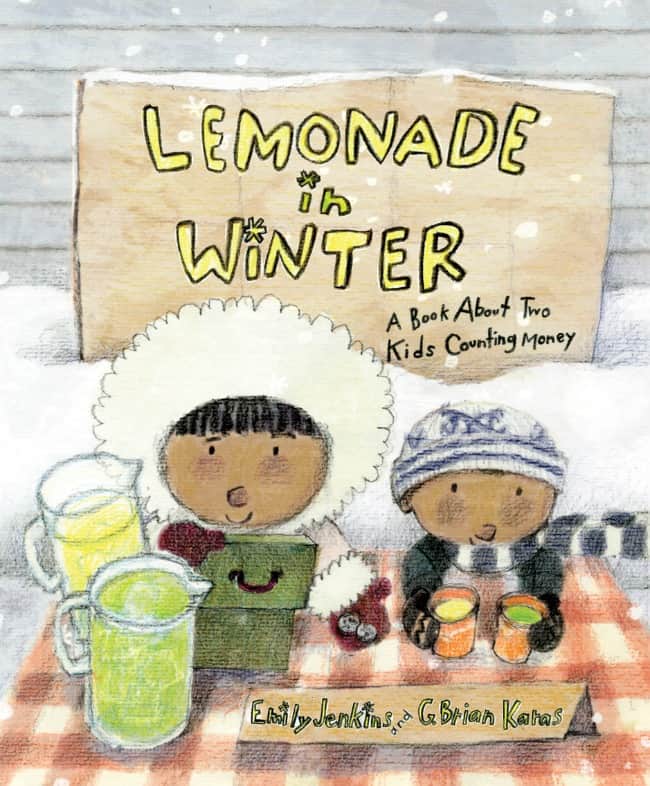

This book, Lemonade in Winter, is a great one to introduce kids to the idea of making, counting, and spending money.

5- Read up about how to teach your kids about money.

A big part of teaching kids about money is showing them the long-term value of saving. For example, if you’re thinking ahead to tuition, websites like Savingforcollege.com can help you compare different ways to prepare for those future costs. Community partnerships like Crosby Scholars can also help you find scholarships and more. You can also find age-appropriate activities and lesson ideas through groups like the Jumpstart Coalition, which focuses on building financial literacy in kids and teens.

For more tips on how YOU can save money, check out my Mom’s Guide to Saving Money book!